summit county utah sales tax

The 2018 United States Supreme Court decision in South Dakota v. The Utah state sales tax rate is currently.

Utah Government And Society Britannica

Summit County Fiscal Office Kristen M.

. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend. Utah has a 485 statewide sales tax rate but also has 208 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2053 on top of the state tax. See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax.

The Summit County 2021 Tax Sale will be held on. Has impacted many state nexus laws and sales tax collection requirements. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds.

County Jan-18 11917001 24238463 3737024 75292525 13963108 55689080 30979593. 22000 summit county 64862163 496370 64365793 000 64365793 000 utah state tax commission division of revenue accounting utah code 59-12-2218biic march 2022 2022-09 totals. Utah has state sales tax of 485 and allows.

The entity that had the second highest swing was Summit County government. Complete the online building application. In Utah the County Tax Collector will sell Tax Deeds to winning bidders at the Summit County Tax Deeds sale.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Bids Request for Proposals. Estimated Combined Tax Rate 715 Estimated County Tax Rate 155 Estimated City Tax Rate 000 Estimated Special Tax Rate 075 and Vendor Discount 00131.

Summit County Utah Recorder-4353363238 Assessor-4353363211. The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County. Summit County Home Page.

Total distrib total deduct final distrib balance owed total paid balance fwd 64862163 496370 64365793 000 64365793 000. Generally the minimum bid at an Summit County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. The entire combined rate is due on all taxable transactions in that tax jurisdiction.

The restaurant tax applies to all food sales both prepared food and grocery food. Report and pay this tax using form TC-62F Restaurant Tax Return. Payments by Mail or in Person To submit your property tax payment by mail make checks payable to Summit County Treasurer.

To review the rules in Utah visit our state-by-state guide. Access county bids and request for proposals. The Summit County sales tax rate is.

When using the envelopes included with your tax notice please make sure to include the coupons with your payment. Sales Tax and Use Tax Rate of Zip Code 84017 is located in Coalville City Summit County Utah State. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

A county-wide sales tax rate of 155 is. The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables.

Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. Average Sales Tax With Local. Conference Room Policy PDF Flood Plain Maps.

The countys 2021 sales tax collections were up about 23 compared to 2019 and up about 35 compared to 2020. Sales is under Consumption taxes. Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit.

Access Utah sales and use tax rates on the Utah State Tax Commissions website. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Manage Summit County Funds.

Pre-addressed to Summit County Treasurer Lockbox co Alpine Bank PO Box 3918 Grand Junction CO 81502. Beer Alcohol Licensing. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and.

5 State Sales tax is 485. Utah Sales. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

8 rows The Summit County Sales Tax is 155. County County Public Transit. Automating sales tax compliance can help your business keep compliant with.

News Flash Summit County Ut Civicengage

How Healthy Is Weber County Utah Us News Healthiest Communities

Corporate Retention Recruitment Business Utah Gov

4106 W Sierra Dr Park City Ut 84098 3 Beds 3 5 Baths Park City Mchenry Great Rooms

For Sale 9 750 000 Step Inside A Mountain Estate Unlike Any Other Greystone At Glenwild Located Within The Private Gates O Park City Ut Park City Mansions

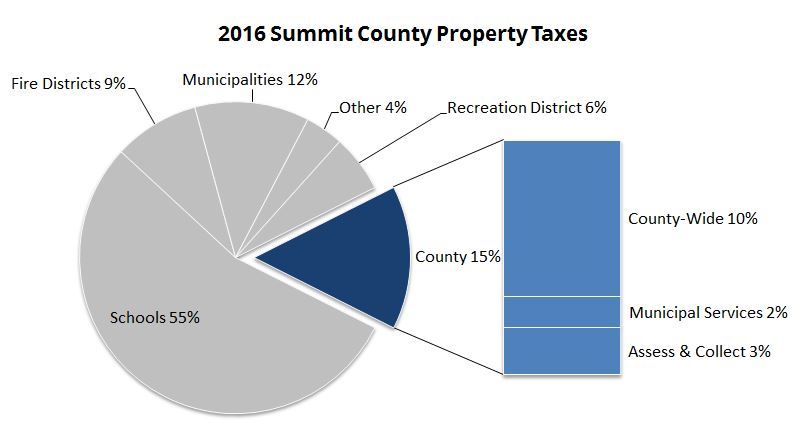

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Summit County Library Utah Home Facebook

File Seal Of Utah Svg Wikipedia

What Would Our Co Rivers Look Like Without Water Water Resources Water Natural Landmarks

Park City Parade Of Homes Lane Myers Construction Utah Custom Home Builders Modern Lake House Mountain Home Exterior Dream House Exterior

Do You Make The Cash To Be In Utah S 1 Percent Cash Utah Investing

Washington County Utah Wikiwand

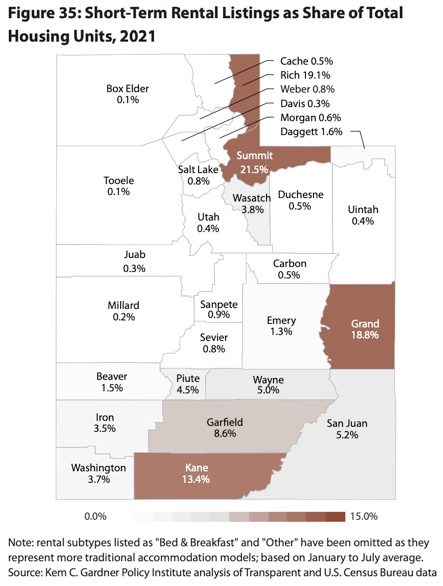

21 5 Of Housing Units In Summit County Are Short Term Rentals Townlift Park City News

Summit County Councilors Confident New Regulations On Rv Sites Are Necessary

Research Shows Affordable Housing Developments Increase Property Values Nearby